The Chinese tinplate market saw notable price adjustments in August, with leading producers increasing rates due to rising raw material costs and steady overseas demand. Market players expect further price hikes in September, driven by supply constraints and speculative buying activity.

In August 2025, major Chinese steelmakers implemented significant price increases for tinplate and TFS products:

| Producer | Product Type | Price Increase | Notes |

|---|---|---|---|

| Baosteel, Yonggang, Meigang, Shougang | Tinplate / TFS | +¥400/ton | Compared to August base price |

| Other tinplate mills | Tinplate / TFS | +¥300–350/ton | Market-wide adjustment |

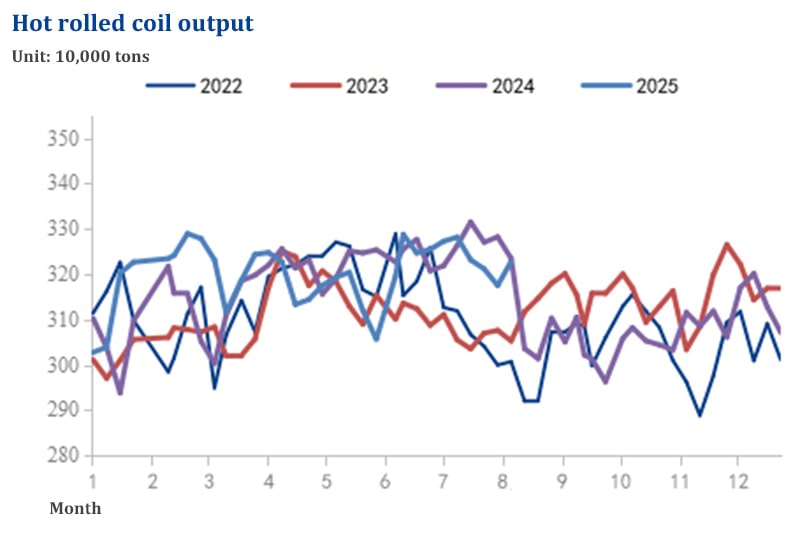

| Baosteel Group | Hot Rolled Coil | +¥100/ton | August pricing |

| Baosteel Group | Hot Rolled Coil (new orders) | +¥200/ton | September orders |

Private enterprises had already raised ex-factory prices by ¥200–300/ton in July, anticipating further increases.

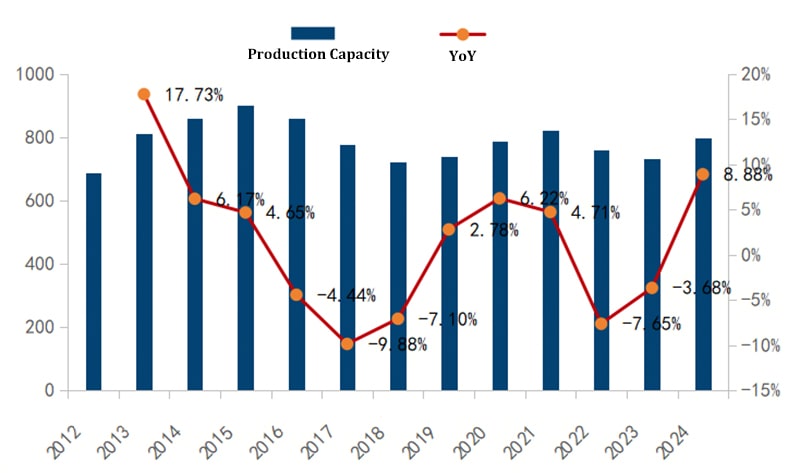

The Chinese tinplate industry is expanding production capabilities:

9 new tinplate/TFS lines in 2025, total capacity 1.85 million tons, mainly starting in H1.

10 approved but unbuilt lines with a projected capacity of 2.2 million tons.

This capacity growth will influence supply dynamics in the coming years, although short-term availability remains tight.

According to market monitoring, August hot rolled coil prices rose by ¥150–200/ton compared to July.

Supply Side: Stable production levels, slight increase in inventories, and long lead times make price cuts unlikely.

Demand Side: Seasonal slowdown continues, with downstream demand soft. Upward movement is limited unless triggered by speculative buying.

Market Outlook: Prices have little room to fall in the near term and may rise modestly due to positive sentiment and opportunistic purchasing.

Tin ingot prices rose by ¥3,200/ton, pushing 0.20mm 2.8/2.8 tinplate prices up $1.5–2/ton.

Tinplate mill profits fell slightly by ¥25/ton but remain relatively stable

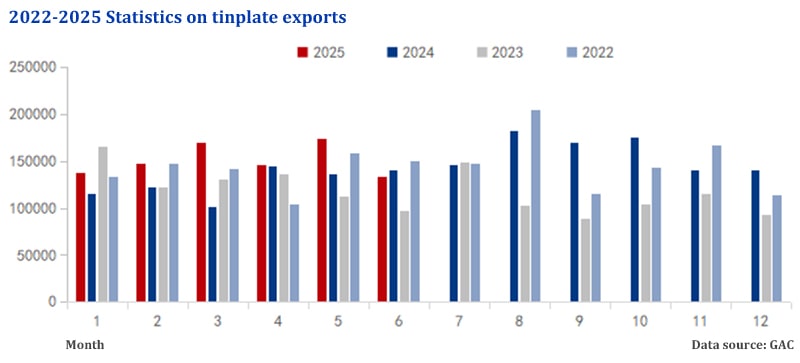

| Period | Tinplate Export Volume | % Change YoY | TFS Export Volume | % Change YoY |

|---|---|---|---|---|

| June 2025 | 132,900 tons | -5.40% | 42,000 tons | +57.82% |

| Jan–Jun 2025 | 907,100 tons | +19.24% | 302,500 tons | +57.05% |

Exports in June dipped slightly due to earlier order rushes.

First-half exports show strong growth, but H2 growth may slow.

Tinplate application breakdown in China:

| Industry | Market Share |

|---|---|

| Beverage cans | 25% |

| Food cans | 24% |

| Chemical containers | 15% |

| Miscellaneous cans & gift boxes | 12% |

Beverage and canned food production trends directly influence tinplate demand.

Beverages: Jan–Jun output 93.09 million tons (-5.11% YoY)

Dairy products: Jan–Jun output 14.33 million tons (flat YoY), June output 2.546 million tons (+4.90% YoY)

ORG Packaging announced two major investments:

Thailand: RMB 442 million two-piece can production line targeting beer, functional drinks, and carbonated beverages.

Kazakhstan: RMB 647 million two-piece can plant for regional demand expansion.

The 2025 Fortune Global 500 ranked China Baowu Steel Group as the world’s largest steel company, with $125.1 billion revenue, leading in high-end plate products and hydrogen metallurgy technology.

Order books for major producers like Baosteel (Europe) and Shougang (US) remain full, with lead times exceeding 50 days.

Analysts expect:

September tinplate prices: +¥200–300/ton increase.

Continued upward momentum through H2 2025, especially with production cuts limiting supply.

From a production standpoint, tinplate manufacturers are walking a fine line between passing on rising raw material costs and maintaining competitiveness in export markets. The balance is heavily influenced by downstream demand from beverage and food tinplate can sectors. Any recovery in these industries could accelerate price increases, while prolonged weakness might stabilize the market temporarily.

With both domestic and international demand shaping price movements, the tinplate market in late 2025 is entering a pivotal phase.

If you’re sourcing tinplate or TFS, locking in orders early could help you avoid cost increases in Q4.

Contact us today for the latest pricing, technical specifications, and tailored supply solutions.

What’s your outlook for the tinplate market in the next six months? Share your thoughts below!